LLC operating agreement template

When setting up a company, founders typically don't want to be liable for the company's debts or obligations. In this scenario, you need to create a limited liability company (LLC).

An LLC operating agreement defines how your company should be run, laying the groundwork with a series of protocols and rules related to finances, management, ownership, and responsibilities. This agreement is to LLCs what a bylaw document is to corporations.

If you are starting your own business, we offer a free and customizable LLC operating agreement template to help guide you in the right direction. It can be filled out and signed in just 4-5 minutes!

Note: Be sure to tweak this template to suit the legal requirements of the state in which your LLC is registered.

How to sign an LLC operating agreement template

- Download the LLC operating agreement template.

- Fill in the placeholders with your LLC’s details.

- Upload the agreement to Signeasy.

- Send the document electronically to all members with a few clicks.

- Track the signers’ progress.

- Receive updates the moment each member signs the document.

- Securely save a copy of the signed LLC operating agreement to the cloud.

- Share a copy with your state’s Secretary of State.

Understanding the LLC operating agreement template

This legal document outlines the ownership and member duties of your Limited Liability Company. Our LLC operating agreement template also discusses how the company's profits and issues should be approached.

There are two types of LLC operating agreements:

- For single-owner LLCs

- For LLCs with multiple owners

Apart from the number of members, the two differ in the way they are taxed. The IRS considers a single-member LLC as a disregarded entity/sole proprietorship and a multi-member LLC as a partnership. So, the members pay different taxes for both types of entities.

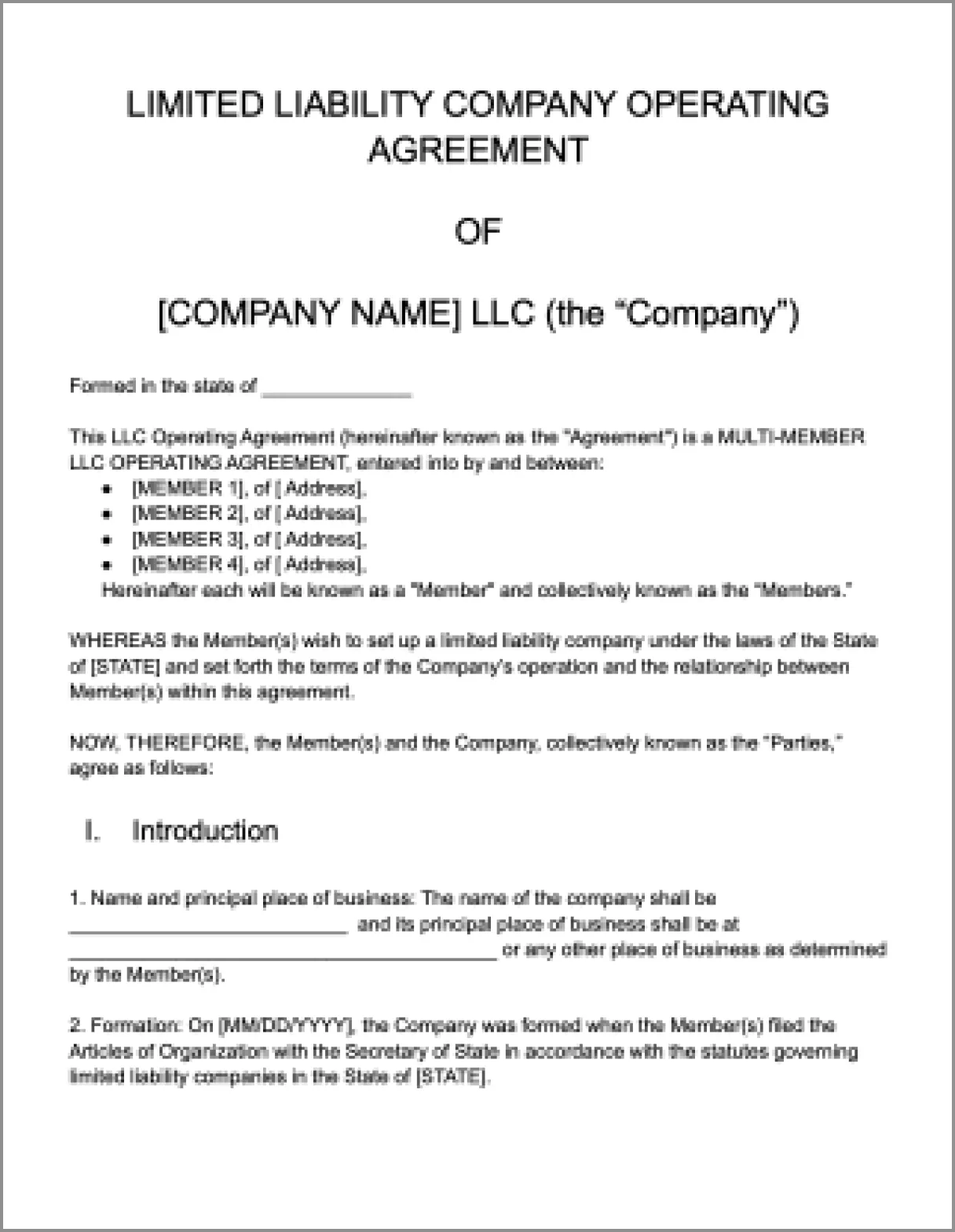

Let’s look over the LLC operating agreement template for a company that has multiple owners:

- Overview

Start off the agreement by adding the company name and declaring that it was formed under a particular state’s laws. Then, mention whether it is a single-member or multi-member LLC (depending on how many owners the company has).

You should also include the names and addresses of the members. The names are usually written in all caps.

Round off the section by confirming that the members wish to set up an LLC.

- Introduction

Set the stage for this operating agreement template by detailing the company name, principal place of business, date of LLC formation, term, fiscal year, and purpose.

Also provide details of the registered agent, who is appointed by the company to accept legal and tax documents on the business's behalf.

The limitation of liability clause is used to protect all parties associated with the LLC from the consequences of misdirected and/or expensive lawsuits. It clarifies that members and employees are personally not responsible for any debt, obligation, or liability belonging to the Company, any of its subsidiaries, or other members.

- Membership and powers

A member is an individual or entity that holds a membership interest in an LLC. Think of them as owners, much like shareholders are to a corporation.

Here, you need to answer the following questions about the company’s membership:

- Who are the members? What membership class do they belong to?

- How many units of voting capital and non-voting capital have they been issued? And how can it be used?

- When, why, and where are member meetings held?

- What percentage of the company do the members own?

- How can voting members exercise their powers to manage the company?

- How many members need to be present at a meeting for a decision to be made and enacted?

- Can a member delegate their powers and responsibilities to other agents?

- How does one add new members?

- Can members transfer their interest in the business?

Throughout this operating agreement template, you will find instances where certain company decisions can be made only if you have unanimous consent on behalf of the members.

Note: For a single-member LLC, the sole owner will retain 100% ownership of the entity.

- Capital contributions

How much capital (money or other assets) should each member contribute when initially added to the LLC to help fund its set-up and operations? Where is the money stored? Can it be withdrawn? Should new members contribute capital? Can they earn interest on this capital? All these questions and more are answered in this section.

- Profit, loss, and distribution

Describe how the profit or loss made by the LLC should be calculated and distributed amongst the members. According to this agreement, for a multi-member LLC, the profit and loss is doled out annually in proportion to their percentage of ownership interest.

- Capital outflow

The agreement notes that expenses related to the management and organization of the company are typically borne by the organization itself. You should also mention that members are not paid salaries for their duties to the company.

- Financial record keeping

This article outlines how the LLC’s books and records are kept, including:

- Where the records of each member, capital accounts, certificate of formation of the company, income tax statements, financial statements, copy of this agreement, and all other reports related to this LLC should be stored

- How often audits of the company affairs need to be done

- Where the company funds need to be deposited

- How members can request an inspection of the company’s books

- Other clauses related to the taxability of the LLC

- Company dissolution and liquidation

In the event that the company needs to close permanently, this section can help members come to a consensus on the dissolution and liquidation process. In this agreement template, we have outlined the many conditions under which a dissolution of the LLC is legally possible.

Once dissolved, an elected Liquidating Member is responsible for the liquidation of the company’s assets and distribution of the proceeds amongst the members.

- Indemnification

This is a fairly standard clause found in most multi-party agreements. It simply states that the members will not be held responsible for any actions they may have performed on behalf of the company unless they were with nefarious intent.

The agreement also mentions that the company has the right to purchase an insurance policy that covers the members in case of any legal proceedings.

- Confidentiality

This section talks about how the company’s information and trade secrets can only be used for the benefit of the LLC and not be shared with third parties. It is meant to safeguard the LLC’s intellectual property.

- Representations and warranty

In this article, members acknowledge that they are getting ‘ownership’ of the company’s membership units solely for investment purposes, and that they don't intend to resell, distribute, or share them with others. They must also not secure membership buy-in on behalf of anyone else. Here, it would be helpful to also outline the conditions under which membership can be sold or transferred.

The authorization clause states that members are of legal age to be part of this agreement and that all their actions will not breach any of the laws that govern the LLC.

- Miscellaneous

Many standard clauses are listed in this section, from arbitration to severability and governing law to counterparts.

Here is the gist of what each clause is about:

- Arbitration: Outlines how disputes relating to this agreement need to be sorted out.

- Binding and legal: Mentions all the individuals and entities that are legally bound by this agreement.

- Severability: Mentions that the agreement will still hold even if a few clauses are deemed invalid.

- Governing law: Mentions which state’s law will govern this agreement.

- Further assurances: Outlines how a member can authorize other members to perform actions on their behalf.

- Heading: States that the headlines in this agreement are only there for reference purposes and do not change the meaning of the agreement in any way.

- Entire agreement: Mentions that any deletions or amendments to the agreement will require written consent of all members and that this agreement cancels all prior agreements.

- Counterparts: States that this agreement might be signed by each individual on different copies and that all the counterparts together make the LLC operating agreement valid.

- Notices: Mentions how to send notices to members.

- Survival: Outlines the clauses that will continue to stay functional even if the company and agreement are terminated.

- Member signatures

This is the signature page, where all members demonstrate their willingness to abide by the terms of the agreement by signing on the dotted line. You may use an eSignature solution such as Signeasy to share this operating agreement template with members so that they may sign it at the same time.

- Exhibit 1

Finally, Exhibit 1 clearly demarcates how many units of the company each member holds, along with their percentage of voting capital, percentage of total capital, and capital contribution.

Note: LLCs assign a percentage of company ownership to each member based on their capital contribution. Make sure the ownership percentages add up to 100%.

Articles of organization vs operating agreement

A company’s Articles of Organization (aka Certificate of Formation) is filed with the state government when the LLC is registered, whereas an Operating Agreement is an agreement between members of a Limited Liability Company about how to run it.

Also, the latter does not need to be submitted to the state government.

Benefits of using an LLC operating agreement

Most states don’t require you to have an operating agreement, but for the protection it offers to its founders, it's strongly recommended that you create one for the following reasons:

- Avoid personal liability for your business activities: Without an operating agreement, your company is essentially a sole proprietorship or partnership. This means your company’s owners could be held liable for any legal implications related to your business, even if you claim to be an LLC. An operating agreement ensures that the validity of your LLC status is not questioned.

- Makes member agreements more enforceable: Verbal agreements can lead to confusion and miscommunication. Therefore, when LLC members come to any agreement amongst themselves, they need to be recorded in writing. An operating agreement sets the rules to help manage such agreements.

- Gives the state guidelines to manage your company: This agreement establishes the rules and structure for running your LLC. So, if ever the state needs to step in and govern the inner workings of your LLC, this operating agreement can act as a playbook.

Choose Signeasy to approve the LLC operating agreement

The traditional route of getting your LLC operating agreement approved will involve a drawn-out series of printing, couriering, signing, scanning, emailing, printing, and so on.

It can take days, and often weeks, to get this contract reviewed and accepted by all parties.

Skip the paperwork runaround: Signeasy is a much quicker and touch-free way to sign and share documents.

- Store editable agreement templates on your account so you don't have to create a new document from scratch every time

- Sign your LLC operating document (or any document) from anywhere, with easy-to-use mobile and desktop apps

- Track the progress of your paperwork, and immediately get notified when a member signs the agreement

- Stop waiting for one member to sign before the next one can. The agreement can be sent to all members at the same time, so that they can sign the document in parallel

Want to get all members to remotely sign your LLC operating agreement for free? Check out Signeasy’s 14-day free trial. You won't even need a credit card!

LLC operating agreement FAQs

Does an LLC operating agreement need to be notarized?

No, the LLC operating agreement does not need to be notarized.

Is an LLC operating agreement a contract?

Yes, an operating agreement is a legal contract that helps establish the rules, regulations, and principles by which an LLC operates. Once signed, it binds all the members of the LLC to these provisions.

How do I get an operating agreement?

You need to choose a name for your business and secure a registered business agent in the state where your company is registered. Then, you may either get a lawyer to draft the agreement for you, or use Signeasy’s free LLC operating agreement template for multi-party LLC dealings. And finally, have all the members sign the agreement.

Does a single-member LLC need an operating agreement?

Whether it is for single- or multi-member LLCs, most state jurisdictions do not enforce the filing of an operating agreement—though it is recommended. States such as Delaware, California, New York, Maine, and Missouri require you to create this agreement, but you are not required to submit it to the state.

Template Preview