Small Business Expense Report Template

Ever wonder how much money is being spent to keep a company, project, or department running? Being able to answer this question is key to being bootstrapped and making sure your small business has its books in order. An expense report can help you track itemized spending so that you know exactly how your money is being put to use.

This article explains what an expense report is, how to create one, and what are the benefits of using an eSignature solution to approve a document like this.

What is an expense report?

An expense report is a form that employees and managers fill out with their regular business expenditures. It summarizes all of the costs incurred by an employee, associated with running a business, from airfare, meals, and office supplies to lodging. By itemizing expenses, the form helps your company track business costs and makes it easy to avail tax deductions. The expense report also simplifies the processing of employee requests for out-of-pocket reimbursements.

3 types of expense reports

Small business employees purchase goods or services every day, month, and year. To maintain a clear record of which employees spent out-of-pocket, how much they spent, and what they spent money on, you should use an expense report.

There are three main types of expense reports you can choose from:

- One-time expense report

When there aren't too many expenses to track, a one-time expense report is ideal. This is the simplest of the three formats. It features itemized expense data, the employee’s personal information, the pay period, and the description of the business expense. Also, it will have a signature block for the employee and their manager to sign.

- Recurring expense report

Do your employees have regular expenses to report? For example, this format may be best for someone who travels for work often or pays for frequent sales lunches on behalf of the company.

In such cases, adding a line item for each expense will make for a lengthy report, so it’s best to use the recurring expense report format. This form collates all daily expenses into one row. It also organizes expenses by category. To enable this kind of reporting, you will need to assign a column to each common expense type. To continue with the example of the frequent traveler, their recurring expense report would have a separate column for expenses related to “Hotel,” another for “Transport,” another for “Meals,” and so on. The employee would need to input their daily expenses under these headers.

From company to company, these columns will vary based on which categories account for the most spending. This form will also have an expense description column and sections for the pay period, employee information, and signatures.

- Long-term expense report

The first two formats are more focused on making it easier for employees to get their out-of-pocket expenses reimbursed. On the other hand, businesses use long-term expense reports (quarterly and yearly) to create a comprehensive view of money spent over a longer period. While this format is very similar to the recurring expense report, it condenses monthly expenditures into one row. There is also a row that features the total amounts spent for each category per quarter or year.

Expense Categories

Travel Expenses

Under this category, you will track and document all expenses associated with business travel. This includes costs related to transportation, such as airfare, train tickets, or car rentals. It also covers accommodation expenses, meals and incidentals while traveling, parking fees, tolls, and any other costs directly related to business trips. Properly categorizing and recording these expenses is essential for managing travel budgets and ensuring accurate reimbursement.

Meals and Entertainment

In this category, you will record expenses incurred for business-related meals and entertainment. It encompasses the cost of meals, beverages, and entertainment activities conducted with clients, partners, or colleagues. This can include client dinners, team lunches, networking events, or any other business-related social gatherings. Following any company policies or guidelines regarding reimbursement limits for meals and entertainment is important to maintain transparency and control expenses.

Office Supplies and Equipment

This category covers expenses associated with office supplies, equipment, and furniture necessary for the smooth functioning of your business. It includes the cost of stationery, printer supplies, computer accessories, office furniture, and any other tangible assets needed for day-to-day business operations. Properly tracking these expenses ensures efficient budgeting and helps manage inventory levels effectively.

Utilities and Rent

Under this category, you will record expenses related to office space, utilities, and rent. It includes the cost of monthly rent payments, electricity, water, heating, internet services, and other utility bills directly associated with maintaining your business premises. Accurately documenting these expenses allows you to monitor and manage your office-related costs effectively.

Marketing and Advertising

This category encompasses expenses incurred for marketing and advertising efforts aimed at promoting your business. It includes costs related to advertising campaigns, online marketing activities, social media advertising, print materials, promotional events, and other initiatives to reach your target audience and increase brand visibility. Tracking these expenses helps assess the effectiveness of marketing strategies and evaluate return on investment.

Insurance and Legal Fees

Under this category, you will document expenses related to business insurance and legal fees. It includes payments made for insurance coverage, such as general liability insurance, professional liability insurance, or workers' compensation insurance. Additionally, it covers any legal fees incurred for legal advice, contract review, or other legal services necessary for the operation and protection of your business. Properly categorizing these expenses ensures compliance and enables accurate financial reporting.

Miscellaneous Expenses

This category encompasses any other business-related expenses that do not fit into the previous categories. It includes a wide range of incidental expenses that may arise in the course of running your business, such as bank fees, subscriptions, memberships, professional development courses or conferences, postage, shipping costs, and other miscellaneous expenditures. Properly documenting these expenses ensures that no expenses are overlooked and helps maintain accurate financial records.

In this article, we will focus on better understanding the recurring expense report.

Common contents of an expense report

For a small business, detailed expense reports make it possible to have a finger on the pulse of a company's expenses. If you want to eliminate the effort that goes into creating your own expense report outline, use an existing expense report template like the one provided below.

Some of the basic elements that feature in most recurring expense report templates are as follows:

- Header, employee details, and pay period

The best way to start an expense report is with the company logo and details for the employee who will be submitting the document. It should also mention the period for which you are submitting the expense report.

- Expense details

This is arguably the most important part of the report. You need to individually map out the details of each expense, slot them under different headers, and add up their total for each day.

Some of the details you must include for each day’s expense:

- Date: When did the employee spend the money?

- Account: Which expense account did the employee use?

- Description: What was the reason for the spending?

- Categories: How much did the employee spend on different things such as transport, hotel, fuel, etc.?

- Total: What is the sum of the daily expenses across categories for each day?

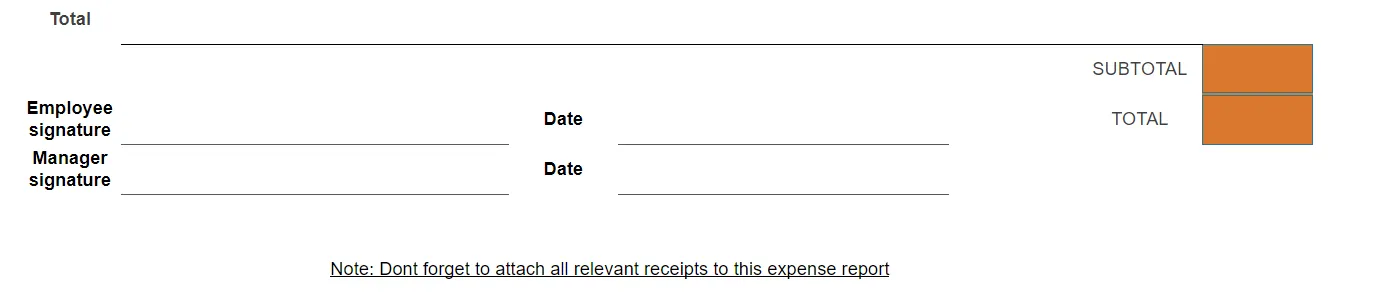

Then, you can calculate the subtotal and total for the entire payment period. There should also be a provision to view the total sum spent on each category.

- Signature

Once the expense report is complete, the employee needs to sign it to certify that the data is accurate to the best of their knowledge. Then, they must send it to their manager, who also needs to sign off on the expense report. The employee must remember to attach all relevant bills and receipts with the expense report before submitting it.

What is an expense report used for?

While an expense report seems like a very plain and basic document, it holds great value for your small business.

This document can help you answer the following questions:

- How much is the company spending? What is its overall cash flow?

- How much profit is the business making after deducting expenses?

- How much should the company reimburse each employee?

- How much has the business spent on a specific project, department, or expense category?

- How much tax can the business write off in lieu of the financial period’s expenses?

There are the three main reasons for which small businesses use expense reports:

- Expense tracking

Businesses on a budget are always conscious of their cash outflows. With an expense report, you can track each expense and even calculate which categories require the greatest expenditures.

- Employee reimbursement

Employees tend to pay for many office costs out-of-pocket, like entertaining clients and costs incurred during business trips. Obviously, the company needs to reimburse them for the same.

But how does the company know which claims to approve and which to reject?

To determine whether the reimbursement claims are legitimate, expense reports come in handy. Itemized expenses will give you a clear picture of when and what the employee spent money on.

- Tax-saving

During tax season, proof of expenses makes it easy to claim tax deductions. Be sure to use IRS’s expense categories in the report to make the tax filing faster and more seamless. Some of the categories to include are:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract labor

- Employee benefit programs

- Insurance

- Interest

- Mortgage

- Legal and professional services

- Office expenses

- Rent or lease

- Repairs and maintenance

- Taxes and licenses

- Travel and meals

- Utilities

- Wages

Steps in the expense reporting process

- Select an expense report template: Instead of starting from scratch, your employees can use Signeasy’s expense report template to input details of each expense incurred.

- Customize the report to your needs: While the standard template is a great place to start, there may be some unique expenses that your business has to account for. In such cases, you can tweak the report by adding or deleting expense category columns. For example, businesses that spent a lot on legal counsel will need to add a ‘legal and professional services’ column.

- Enter information about the expenses: Each expense must be carefully and accurately represented in the form, and your employees must report the expenses in the order in which they were incurred. This means the most recent expenses will need to be mentioned at the end of the form.

- Calculate the total: Add all the reported expenses of each category together to obtain subtotals. This will help you understand how much is being spent on each category. Add all of these subtotals together to arrive at the grand total.

- Attach receipts: To offer proof of expenses to the accounting team for reimbursement claims, your employees must attach scanned copies of relevant receipts to the expense report. This will also help you retain records for tax purposes.

- Sign and send: Once the reported expenses have been reviewed, the employee must sign the document using an eSignature solution. They can then use the same technology to send the form to their manager for approval.

How to sign the expense report

- Upload the completed expense report to Signeasy.

- Choose the Sign Document option.

- Click on the Sign button.

- Draw, type, or upload the signature of your choice.

- Click Finish to complete the online document signing.

Why should you go paperless with expense reports?

Everything in the workplace has become remote and digital. Shouldn’t your expense reports be the same?

A powerful eSignature solution ensures that your employees won't have to carry around notepads and pens to jot down their expenses.Additionally, electronically signed expense reports are just as legally binding as an analog signature. An eSignature platform will also save your team a lot of time, doing away with the need to print, physically sign, and visit approvers’ offices to manually submit the document for processing. It also saves on costs of paper, ink, courier, etc. Perhaps the most important benefit of this paperless technology is that it improves the employee experience and ramps up productivity.

Ready to try out this new signing workflow? Click here to register for Signeasy’s free trial.

Template Preview