Download Free Promissory Note Template

Whether you are lending money to a friend, financing a real estate purchase, or formalizing a business loan, a promissory note template protects both parties by documenting the terms of repayment. Signeasy offers free, customizable promissory note templates that you can download, complete, and sign electronically in minutes.

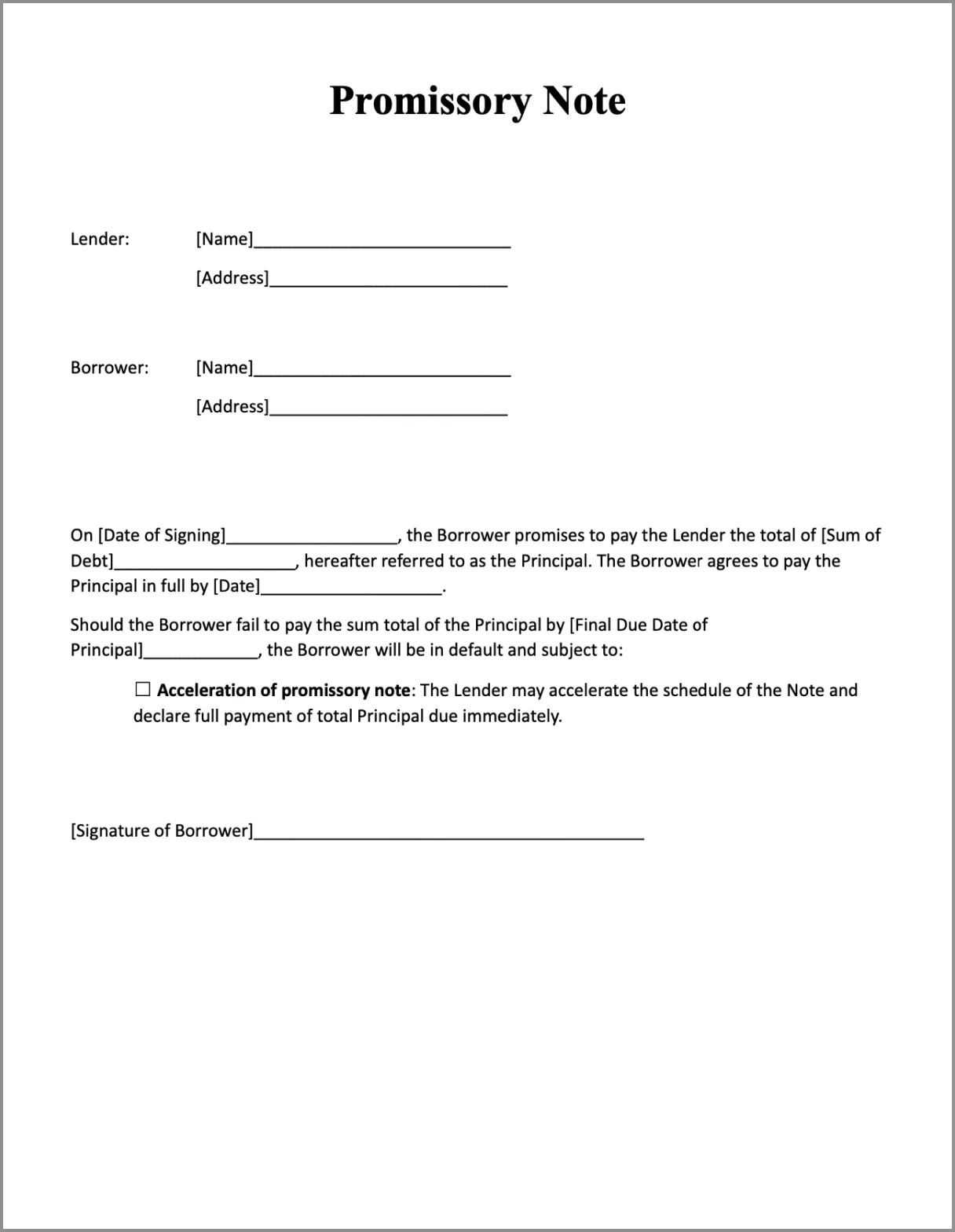

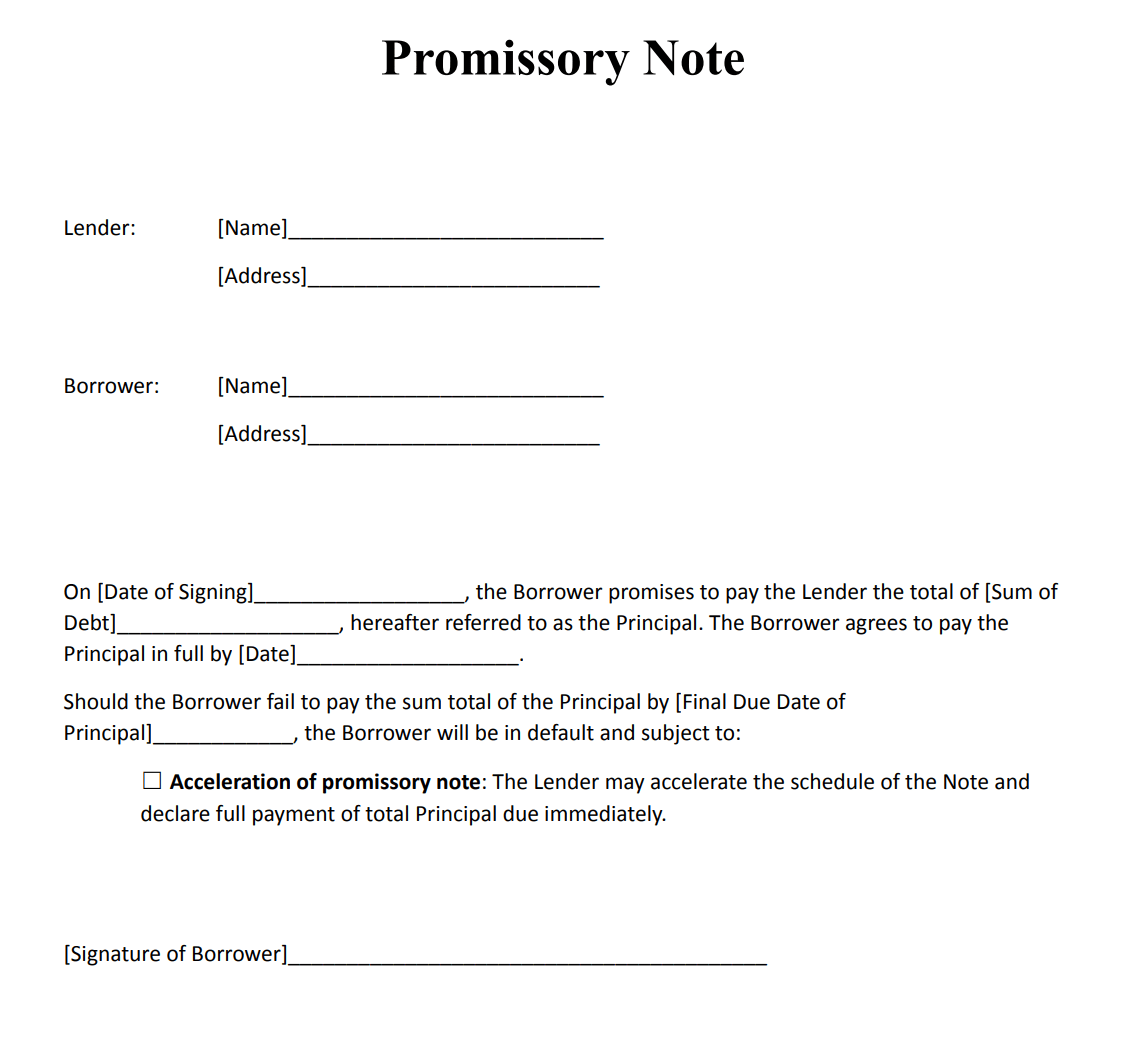

We provide two free promissory note forms: a simple promissory note for straightforward personal loans, and a secured promissory note template with clauses for collateral, interest rates, and payment schedules. Both templates are legally sound and ready for electronic signature.

What is a promissory note?

A promissory note is a legally binding written agreement in which a borrower promises to repay a specific sum of money to a lender under defined terms. Unlike a simple IOU, a standard promissory note includes details about repayment schedules, interest rates, and consequences for default.

Promissory notes are governed by Article 3 of the Uniform Commercial Code (UCC) in the United States. The borrower must sign the document to make it enforceable, though the lender's signature is not legally required. For added protection, many parties choose to use electronic signatures to create a verifiable audit trail.

Related template: For more comprehensive lending arrangements, see our loan Contract Template.

Types of promissory notes

Different lending situations call for different types of promissory notes. Understanding these variations helps you choose the right template for your needs:

Simple promissory note

A simple promissory note contains only the essential elements: the principal amount, the parties involved, and basic repayment terms. This type works well for small personal loans between family members or friends where the relationship is trusted and terms are straightforward.

Secured promissory note

A secured promissory note requires the borrower to pledge collateral, such as a vehicle, equipment, or other valuable assets. If the borrower defaults, the lender has the right to take possession of the collateral. This type provides stronger protection for lenders and typically allows for lower interest rates.

Unsecured promissory note

An unsecured promissory note does not require collateral. The lender relies solely on the borrower's promise to repay. While easier to set up, these notes carry higher risk for lenders, and default consequences are typically limited to credit score impact and potential legal action.

Demand promissory note

A demand promissory note allows the lender to request full repayment at any time, usually with a specified notice period. This type offers flexibility for lenders but less predictability for borrowers.

Balloon promissory note

A balloon promissory note features smaller periodic payments followed by one large final payment (the balloon payment) at the end of the term. This structure is common in real estate and business financing where borrowers expect increased cash flow over time.

Master promissory note

A master promissory note establishes terms that apply to multiple loans between the same parties. This type is commonly used for student loans and ongoing business credit relationships, eliminating the need for separate documentation for each transaction.

When should I use a promissory note?

Not every loan needs a promissory note, and not every promissory note fits all styles of loan. We’re going to break down when and why you’d use a promissory note and what happens if you don’t.

If you’re dealing with a bank or a mortgage company, you probably don’t have to worry about a promissory note. They’ll be providing contracts, and you’ll simply be reviewing them (ideally with a lawyer) and signing. You do need a promissory note for private investments and certain kinds of real-estate deals and for personal loans between individuals.

Personal loans might include vehicle sales between private parties, cash loans to family members and friends, or the sale of expensive equipment.

Investments that employ promissory notes generally involve cash injections to small businesses to help them with equipment, payroll, real estate, or other expenses.

Real-estate loans that use a promissory note usually take the place of a mortgage in special circumstances. Homebuyers who have trouble qualifying for a traditional mortgage can use a promissory note to enter an agreement with the current owner of the house. The owner of the house sets the terms of the loan, and the house being purchased becomes the collateral that secures the loan for the buyer.

Real estate promissory note template

Real estate transactions often use promissory notes when traditional mortgage financing is not available or preferred. A real estate promissory note template is essential for seller financing, private lending, and owner-carried mortgages.

Common real estate scenarios: Seller financing occurs when the property seller acts as the lender, allowing buyers who may not qualify for traditional mortgages to purchase property. The promissory note works alongside a deed of trust or mortgage that secures the property as collateral.

Real estate promissory notes typically include longer terms (10-30 years), larger principal amounts, and provisions for property taxes and insurance. They should clearly specify what happens in case of default, including the foreclosure process and any cure periods allowed.

Tip: For real estate investments, also consider using an investment contract template to formalize equity arrangements.

Essential clauses in a promissory note

Every standard promissory note should include these required elements:

- Parties: Full legal names and addresses of the lender and borrower

- Principal amount: The exact sum being borrowed, stated in legal currency

- Promise to pay: Clear language stating the borrower's obligation to repay

- Borrower's signature: The borrower must sign to make the note enforceable

- Date: When the promissory note is executed

Optional but recommended clauses include:

- Interest rate: The annual percentage rate and how interest is calculated

- Repayment schedule: Payment amounts, frequency, and maturity date

- Default clause: Consequences if the borrower fails to pay

- Acceleration clause: Allows the lender to demand full repayment if terms are violated

- Late payment fees: Penalties for missed or late payments

- Prepayment terms: Whether early repayment is allowed without penalty

- Collateral description: For secured notes, detailed description of pledged assets

How to write a promissory note

Follow these steps to create a legally sound promissory note:

- Choose the right template: Select a simple or secured template based on whether collateral is involved. Consider the loan amount, relationship between parties, and level of risk.

- Enter party information: Include complete legal names and addresses for both the lender and borrower. For businesses, use the full legal entity name.

- Specify loan details: Clearly state the principal amount, interest rate (if any), and how interest will be calculated and compounded.

- Define repayment terms: Establish the payment schedule, including amounts, frequency, due dates, and the final maturity date.

- Add protective clauses: Include provisions for late payments, default, prepayment, and if applicable, collateral.

- Review and sign: Have both parties review the document carefully. The borrower must sign, and using electronic signatures provides a clear audit trail.

Pro tip: For payment tracking, pair your promissory note with a payment contract template that details each installment.

Common pitfalls to avoid

Understanding these potential issues helps you create an enforceable promissory note:

- Missing signatures: The borrower must sign the note. While the lender's signature is not required, it is recommended for both parties to sign.

- Unauthorized alterations: Any changes after signing must be agreed upon by both parties. Unilateral modifications can void the entire note.

- Non-monetary promises: The debt must be stated in legal currency. Promises of goods, services, or trades are not valid in a promissory note.

- Lost documentation: Enforcing a promissory note is nearly impossible without the original document. Use digital signatures and cloud storage to maintain secure copies.

- Usury law violations: Interest rates above state-mandated limits can make the note unenforceable. Research your jurisdiction's maximum allowable rates.

Find the laws about promissory notes in your region

Promissory notes, and the laws relating to those notes, differ from country to country. We’ll help you find your local laws regarding loans and promissory notes before you commit to a promissory note template.

In the United States, promissory notes are covered in the “Negotiable Instruments” section of the Uniform Commercial Code. We recommend perusing the language of the code itself if you’re planning on a close examination of a promissory note in the US.

In China, Article 177 and Article 194 of the Criminal Law of the People’s Republic of China discuss the legal ramifications of promissory notes.

In India, the Negotiable Instrument Act of 1881 defined promissory notes and still governs them to this day.

For most countries, the United Nations Convention On International Bills of Exchange and International Promissory Notes covers promissory notes (among many other things) and can be read in its entirety here. This is an excellent default resource for understanding the minutiae of promissory notes; the document is often used as a template for other nations.

Download your free promissory note template

Ready to formalize your lending arrangement? Download Signeasy's free promissory note templates today. Choose between our simple promissory note for straightforward loans or our secured template with advanced clauses for collateral, interest, and payment schedules.

With Signeasy, you can customize your template, add electronic signatures, and securely store your documents in the cloud. Both parties receive digital copies, eliminating the risk of lost paperwork and creating a clear record of your agreement.

Template Preview