Remember that episode from The Big Bang Theory, where Sheldon enforces the infamous “Roommate Agreement” with clauses so detailed that even a minor deviation could send Sheldon into a frenzy. It was also incredibly one-sided, that Leonard was exposed to every whim of Sheldon’s eccentricities.

Sheldon’s ‘Roommate Agreement’ is a perfect example of what happens when contracts are overly one-sided and lack fair risk management. While it was legally binding, it failed to protect both parties equally, leading to endless disputes.

In business, contracts with unclear terms, excessive complexity, or loopholes can have serious consequences. Think of financial losses, legal disputes, and operational disruptions.

To help you figure out the “ifs” and ‘buts” of contract risk management, we’ve put together a simple 5-step process (plus 7 best practices) to make sure your contracts work for you, not against you.

What is contract risk?

Contract risks refer to the potential negative consequences that arise when a contract isn't managed the right way. These risks can emerge from unclear terms, unmet obligations, or external factors like market changes or regulatory updates that disrupt the agreement.

On top of it, overly complex or inconsistent contract management practices can also trigger risk. Eventually, these risks can jeopardize how well a contract works out for both parties, impacting finances, relationships, and even their brand reputation.

Here’s an example of contract risk in action. Party A agrees to deliver raw materials to Party B by a specific date. However, unexpected shipping delays leave Party A unable to meet the deadline. As a result, Party B misses its commitments to its own clients. Here, the ripple effects of contract risk not only harm both parties but also put a strain on their professional relationship.

What is contract risk management?

Contract risk management is a process of identifying, assessing, and mitigating risks throughout a contract’s lifecycle. With proper contract risk management practices, you can protect your business from occasional financial hiccups, legal troubles, and operational disruptions.

This process involves monitoring compliance, clarifying any unclear terms, and planning for any negative circumstances that might come your way. Let’s take a look at two examples to clearly understand contract risk management and how it plays out for different teams:

Example 1: Sales team

Risk: A sales team drafts a contract with vague payment terms—for example, it only states that the client must pay "upon completion of services" without specifying an exact due date. This creates uncertainty around when payments are expected, leading to delayed cash flow, disputes, and potential non-payment.

Management: To prevent this, contracts should specify clear payment schedules (e.g., "50% upfront, 50% upon completion"), define acceptable payment methods, and include penalties for late payments to ensure timely collections.

Example 2: IT team

Risk: A company signs a contract with a software vendor to provide critical system updates. However, the contract lacks specific delivery timelines or performance guarantees, leaving room for the vendor to delay updates indefinitely. This could lead to system vulnerabilities, security risks, and operational disruptions.

Management: To mitigate this, the contract should include detailed service-level agreements (SLAs) that specify update deadlines, performance benchmarks, and financial penalties if the vendor fails to meet their obligations.

A 5-step actionable contract risk management process

Now, we’ll walk you through a 5-step actionable contract risk management process with examples. From identifying potential risks to tracking them regularly, these steps will help you protect your business and ensure every agreement stays secure.

1. Identify risk-causing factors

Before you can manage contract risks, you need to know where they’re lurking. That’s why your first step is identifying what could go wrong at every stage of your contract lifecycle.

Start by asking the big "what and why" questions.

- What could create risks in your contracts?

- Why do these factors matter?

Risks can come from various places:

- Operational risks: Missed deadlines or unclear workflows.

- Financial risks: Hidden costs or vague payment terms.

- Content-related risks: Ambiguous clauses or outdated templates.

- Security risks: Poor storage practices or unauthorized access.

- Legal risks: Regulatory non-compliance or jurisdictional oversights.

So, how do you identify these risks?

- Map the contract lifecycle: Outline every step and stakeholder in your contract process to spot weak links such as, unclear workflows, overlapping responsibilities, or approval issues.

- Audit storage practices: Check where your contracts live. Are they secure and accessible only to the right people? Auditing storage practices regularly ensures your contracts are centralized, secure, and easily accessible to authorized people.

- Stay current: Monitor changes in regulations and industry standards. Geopolitical changes, trade restrictions, or shifts in laws can also impact your contract obligations. Staying current means regularly reviewing these changes and assessing their implications for your contracts.

By pinpointing these risk factors, you’re setting the stage for a solid risk management practice that keeps your contracts (and your business) safe.

Example: Albea Cosmetics’ contract risk challenge

Albea Cosmetics identified operational contract risks when they faced issues with disorganized processes and mismanaged storage. Their contracts often got stuck on someone’s desk or were misplaced, delaying business operations.

After identifying these challenges, Albea adopted Signeasy to centralize document storage and automate approval reminders. This streamlined their workflows and reduced approval delays by 32%.

2. Assess contract risk impact

Not all risks are created equal. Some could disrupt your entire business, while others might have minimal consequences. That’s why it’s really important to assess the impact of each risk you identify. It gives you a clear picture of which risks deserve your immediate attention and resources and which can wait a bit.

Assessing risks involves figuring out their potential consequences on your operations, finances, compliance, and reputation. Ask yourself questions like “What are the potential financial and operational impacts of each risk?” “Which risks pose threats to timelines or regulatory compliance?.”

Here are some more ideas on how you can assess contract risk impacts effectively:

A. Prioritize risks based on severity:

- Rank risks based on their likelihood and potential impact. Use a scoring system (e.g. 1-10 scale) or categorize risks into low, moderate, and high-impact.

- Low risks are manageable and unlikely to cause significant harm, like a minor delay in a deliverable.

- High risks are critical and could severely impact operations, finances, or reputation, for example, a major breach of contract or regulatory non-compliance.

B. Use AI assistance

AI-powered tools can flag risky clauses (e.g., hidden penalties, compliance gaps) and highlight key contract terms that need attention.

Ask AI-driven assistants:

- “What’s the financial impact of a breach?”

- “What are the termination consequences?”

- “Are there any clauses that expose us to high penalties?”

AI can then direct you to relevant sections and provide quick insights, reducing manual review time.

C. Engage experts

- Collaborate with cross-functional teams to gain deeper insights into contract risks.

- Legal teams can spot compliance risks, finance teams can assess penalty clauses, and operations teams can identify workflow-related risks.

Example: How Assante managed high-impact contract risks

Assante, a Canadian wealth management firm managing over $40B in assets, faced high-impact financial risk from manual paperwork process and delays in signatures. These delays led to frozen client accounts, halting trades, and jeopardizing client relationships.

However, once they adopted Signeasy as an end-to-end contract management solution, they

- Speed up document turnaround and meet compliance deadlines.

- Reduce account freezes, preventing unnecessary financial losses.

- Ensure smoother client onboarding, strengthening trust and efficiency.

3. Apply risk mitigation strategies

Once you’ve identified and prioritized your contract risk impacts, it’s time to take proactive steps to lessen the impact. By tackling risks at both the process and contract levels, you can protect your operational workflow. Here’s how you can do that:

A. Mitigate risks across operational processes

- Store all contracts in a centralized contract dashboard for easy access, tracking, and management.

- Automate your contract drafting, approval, signature, and storing processes to avoid bottlenecks and ensure timely reviews and signatures.

- Use automated alerts or notifications for important dates like renewals, deadlines, or performance evaluations.

B. Address risks at the contractual level

- Background checks should extend to both counterparties and the contract itself. For counterparties, focus on assessing their financial stability, compliance history, and reputation. And, for contracts, do a thorough check for clear terms, purpose alignment, and regulatory compliance to mitigate partnership risks effectively.

- Assess contract obligations to make sure they are achievable within your resources, timelines, and capabilities. This will prevent you from overcommitment and smooth execution without unnecessary strain or delays.

- Define timelines for deliverables and payments to minimize misunderstandings or penalties.

Example: How SOHAR Port and Freezone reduced contract risks

SOHAR Port and Freezone needed a way to eliminate contract bottlenecks and improve efficiency. By automating their contract workflows with Signeasy, they:

- Reduced contract processing time by 80%.

- Ensured faster approvals and document turnaround.

- Minimized operational delays and compliance risks.

4. Transfer your contract risks

Sometimes, sharing or transferring risks is the smartest move. Imagine one party (A) hires another party (B) for a construction project. If Party B’s work leads to damages, who bears the cost? This is where contractual risk transfer comes into play.

It's a process where one party shifts specific risks, like financial liability or damages, to the other party through legal agreements. The idea is simple: the party best equipped to manage or mitigate a risk takes responsibility for it. This approach is common in subcontracting, lease agreements, and sales contracts.

When establishing a clear contract risk transfer, asking the right questions is essential to ensure fairness. So, make sure to brainstorm questions like

- “Who is better equipped to manage or prevent specific risks?”

- “Does the contract include indemnity or insurance clauses to protect all parties?”

- “Are potential risks and liabilities clearly outlined and agreed upon?” etc.

How to achieve this:

- Use indemnification clauses to hold one party accountable for specific damages or losses. Add limitation of liability clauses to cap potential damages.

- Transfer financial risk to insurers by purchasing tailored coverage for identified risks. Consider a waiver of subrogation to prevent insurers from pursuing the non-liable party.

- Partner with entities experienced in managing particular risks, ensuring better control and reduced liabilities.

5. Track and manage risks continuously

Contract risk management doesn’t stop once a contract is signed—it’s a dynamic process. Because contracts are like living documents that evolve over time. Even small changes in regulations, market conditions, or even shifting business needs can all affect it.

By staying proactive about managing these risks, you can make sure your agreements stay beneficial and compliant throughout their entire lifecycle

How to monitor risks continuously:

- Stay updated on changes in laws, industry standards, or business conditions to spot clauses that may need revisions to maintain compliance or align with shifting priorities.

- Use performance metrics to identify risks early. Monitor KPIs like deadlines, quality benchmarks, and financial metrics to catch deviations before they escalate into bigger problems.

- Schedule routine compliance audits to ensure the terms of your contracts are still relevant and enforceable. This helps address gaps in obligations and avoids legal or financial pitfalls.

- Use contract management tools with analytics features to forecast potential risks. By identifying patterns in contract performance, you can proactively address weak points or emerging threats.

- Involve stakeholders like legal teams, finance, and operational managers in periodic reviews. Their insights can uncover risks or inefficiencies that might otherwise be overlooked.

- Keep a centralized log of identified risks, mitigation strategies, and action items. This ensures accountability and a clear roadmap for addressing vulnerabilities.

- Regularly assess the financial stability, compliance, and performance of vendors or partners to ensure they remain reliable.

7 Best practices for contract risk management

Now alone, the risk management process itself won’t be much help if you don’t supplement it with some good practices. Here are seven contract management best practices to ensure you're assessing and mitigating the risks with perfection:

1. Build a clause and template library

Standardized clauses and templates are your best friends when it comes to reducing contract risks. By putting together a comprehensive library, you can keep everything consistent and steer clear of mistakes.

Plus, legal teams can set up pre-approved clauses that cover important risk areas, such as liability, confidentiality, or termination. This not only speeds up the contract drafting process but also makes sure that every agreement is in line with your organization's risk appetite.

Check out Signeasy’s template library to draft contracts!

2. Tighten security with role-based access

Another great way to keep your contracts secure is by using role-based access. It helps you control who can view, edit, or approve your contracts. This helps you protect sensitive information while everyone on the team also gets a clearer view of what’s going on.

For example, if an admin is overseeing everything, they can still manage contracts even if some team members are off or unavailable. This way, compliance is maintained, and workflows keep flowing smoothly.

3. Conduct regular contract audits

Always make sure to do periodic audits to identify risks hidden in your existing contracts. Review older agreements to ensure they’re still compliant with current laws and business goals.

Regular audits can also uncover inefficiencies, missed opportunities, or obligations that need your attention. This proactive approach ensures you’re always prepared for internal or external scrutiny.

4. Stay alert with automated reminders

Missed deadlines can result in significant financial or legal repercussions. Use contract management tools to set up automated reminders for important dates. Like when contracts are up for renewal, when they might terminate, or when payments are due. Keeping your team in the loop can really help avoid serious breaches or missed chances.

5. Enable version control for smooth collaboration

Contracts often go through multiple revisions, and managing those versions manually can lead to confusion or errors. Use a version control system to track changes, compare drafts, and make sure the final document is free of errors. This feature also allows all stakeholders to collaborate efficiently. This way, you reduce the chances of miscommunication or letting outdated clauses sneak into the final version.

6. eSignatures for seamless approvals

Make the signing process easier by adopting electronic signatures. eSignatures can significantly cut down on delays, enhance security, and provide a clear audit trail. You can use standalone tools or all-in-one contract management solutions like Signeasy to make sure that contracts can move forward without annoying bottlenecks, while still maintaining legal rules.

7. Use AI for smarter risk management

Using AI-powered contract management solutions is almost like having a smart assistant right at your side during the review process. They can analyze contracts for risky clauses, summarize terms, and even predict potential issues based on past data. This technology not only saves time but also ensures a higher level of accuracy. For example, AI can flag non-standard terms, highlight any missing clauses, or even suggest changes to help reduce risks.

"What if there were an AI that could assist by summarizing the document you are signing? If you wish to know more, it could take you to the right section of the document. With the new Signeasy AI features, that is exactly what you can do."

Thiyagarajan M (Rajan) | Managing Partner

The difference between contract management and contract risk management

Contract management and contract risk management serve different purposes, but they complement each other perfectly to safeguard your business operations.

Contract management is mainly an administrative process. It focuses on managing the entire lifecycle of contracts—from drafting and negotiation to execution, renewal, and storage. It’s a broader process that keeps contracts organized, accessible, and moving along efficiently.

Contract risk management, on the other hand, zeros in on identifying and mitigating risks tied to those contracts. It helps you prevent potential issues, such as compliance failures, unfavorable terms, or missed deadlines before they occur.

These two processes work closely together. Contract management helps keep things organized and efficient. At the same time, contract risk management protects your organization from potential troubles.

Together, they create a robust contract strategy. One that ensures smooth execution while proactively minimizing risk.

Why is contract risk management important?

Contracting inefficiencies cost businesses an average of $1.5 million in missed revenue. Missed deadlines, overlooked clauses, and unfulfilled obligations account for about 9.2% of annual revenue losses for businesses.

That’s a big dent in profits. So adopting best practices for contract risk management isn’t just a smart move, it’s a need for protecting your business in the long run. Here are some more reasons to convince you why contract risk management is important:

- No one wants to deal with penalties or legal trouble because of a missed regulation. Contract risk management helps you stay aligned with changing legal requirements, so you don’t have to worry about costly penalties.

- When deadlines slip, clauses get ignored, or obligations aren’t met, it starts to eat into profits. Following best practices for contract risk management ensures these critical details don’t fall through the cracks, saving money and avoiding unnecessary stress.

- A single contractual misstep can tarnish your company’s credibility. That’s why having a solid risk management strategy is so important. It helps protect your brand by making sure that you keep your commitments and run your operations ethically.

- When you take the initiative to identify and manage risks, it sends a clear message to stakeholders that you've got everything under control. It makes them feel more confident about your business processes.

- Understanding possible risks is crucial for your team when making informed decisions about contracts. By thoroughly assessing these risks, you can develop strategies that not only minimize uncertainties but also pinpoint areas for improvement.

A quick overview of 5 types of contract risks

Here’s a quick rundown of the five different types of contract risks, how they occur, and their example:

The Benefits of contract risk management

Addressing contract risks before they escalate can reap immense rewards for your business operations. Here, we’ve listed down some of the benefits you can look forward to once you embrace best practices for contract risk management:

1. Protect your organization's financial position

Contracts often involve significant financial commitments. With effective risk mitigation strategies, you can safeguard your financial health by identifying and addressing potential risks upfront. This ensures you’re entering into agreements that align with your financial goals.

2. Avoid legal and regulatory penalties

Noncompliance with contract-related laws can lead to costly penalties. For instance, noncompliance can result in hefty fines, legal disputes, or, even worse, data breaches. That’s why having a solid strategy for managing contract risks can help you stay aligned with all applicable legal and regulatory standards. You can protect your organization from heavy penalties and keep everything running smoothly and within the law.

3. Reduce operational disruptions

Contract risks can disrupt daily operations. Proactively addressing these risks can keep your business workflow seamless and minimize any potential downtime or inefficiencies that pop up unexpectedly.

4. Protect your brand reputation

Your reputation is everything. Contract breaches, unethical behavior, or confidentiality lapses can tarnish it. Effective risk management prevents these issues, preserving trust with clients, vendors, and stakeholders.

5. Improve vendor and supplier relationships

Strong relationships are built on trust and accountability. By ensuring contracts are honored, and issues are handled proactively, you can foster long-term partnerships with vendors and suppliers.

How Signeasy helps mitigate contract risk

So far, we’ve shared what contract risk management is, the processes, and best practices to protect your business. Now, let’s address the elephant in the room here. Finding a solution that can spot red flags in your contracts before they become full-blown problems.

As Mike Stackhouse, Founder, President, and CEO of SAMSA, puts it, “Signeasy has been one of the most strategic investments we made at SAMSA.”

And it could be just as impactful for your team. But don’t just take anyone’s word for it, let's see how Signeasy’s features can really help you manage contract risks effortlessly.

- Centralized contract dashboard: Signeasy has one of the most intuitive contract management dashboards that makes it super easy for you to organize contracts in one place. From this single hub, you can track and monitor every contract activity across its lifecycle.

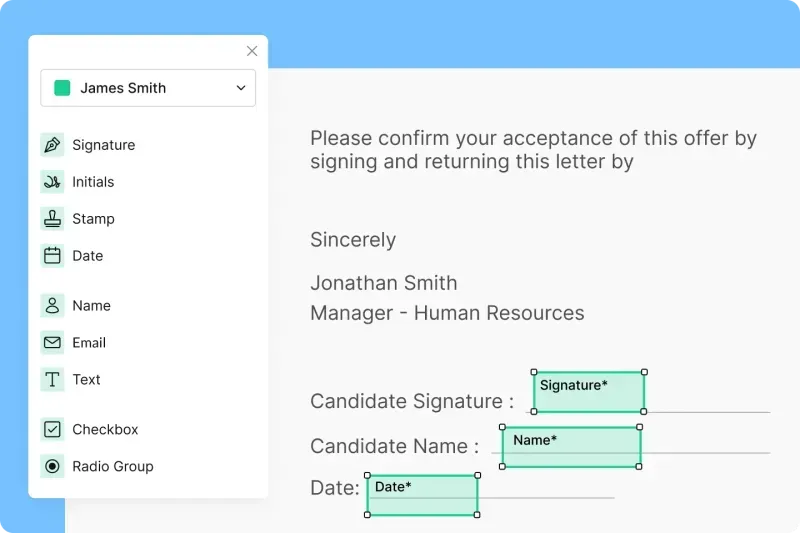

- Automated workflow: Sequential signing guarantees signatures are captured in the correct order. Automated notifications ensure signers know when it’s their turn, reducing miscommunication and manual follow-ups. With our template sharing feature, your team can eliminate version confusion, and your team can track contracts through unique links.

- Data protection: To tackle security risks, Signeasy offers role-based access control and SSO. Paired with two-factor authentication and a tamper-proof Trust Seal, your contracts are secure from unauthorized access and fraud.

- Integration: Signeasy also integrates seamlessly with tools you already use, like Google, Microsoft, and HubSpot, so implementing it into your existing workflow is simple.

- Edit contracts: Mid-process edits no longer mean starting over. Modify signer details, notify involved parties, and maintain transparency through the audit trail. This feature helps adapt contracts to evolving business needs without disrupting workflows.

- AI capabilities: What truly sets Signeasy apart is its AI capabilities. From extracting key terms to summarizing contracts and answering specific queries, Signeasy’s AI tools ensure no critical detail goes unnoticed, helping you make informed decisions faster.

Use Signeasy’s ROI calculator to let the numbers convince your team to schedule a call with us!